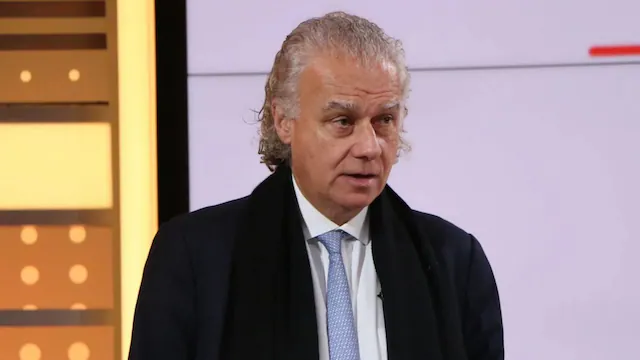

Jefferies’ veteran global fund manager Chris Wood has made further adjustments to his India long-only portfolio, including the addition of InterGlobe Aviation (IndiGo), the country’s largest airline. IndiGo has been assigned a 4% weight in the portfolio, funded by the removal of Coal India Ltd. and a one-percentage-point reduction in investment in industrial company Thermax.

In his latest GREED & Fear note on Friday, February 28, Wood also announced modifications to his global long-only portfolio. His plan includes increasing his stake in Alibaba by one percentage point, financed by trimming his investment in ICICI Bank by the same amount.

Wood highlighted that the recent decline in Indian markets is mainly technical, caused by multiple compression rather than any significant macroeconomic concerns. The Nifty has dropped 14% from its peak, while the Midcap index has fallen 19%. Foreign institutional investors (FIIs) have been aggressive sellers, playing a major role in the downturn.

The sell-off has primarily impacted high-beta domestic cyclical sectors such as real estate, infrastructure, and industrials, which were last year’s top-performing segments. As a result, Wood’s India portfolio, which had a strong weight in these sectors, outperformed the Nifty by 18.7% in U.S. dollar terms on a total-return basis until December 17 but has since underperformed by 12.1%.

Wood also pointed out that any potential easing by the U.S. Federal Reserve could be beneficial for emerging markets, including India, as it would weaken the U.S. dollar.

The Nifty enters the March series after recording five consecutive months of losses.

On Thursday, shares of InterGlobe Aviation closed 0.3% higher at ₹4,442.3 but remain 12% below their peak of ₹5,035.