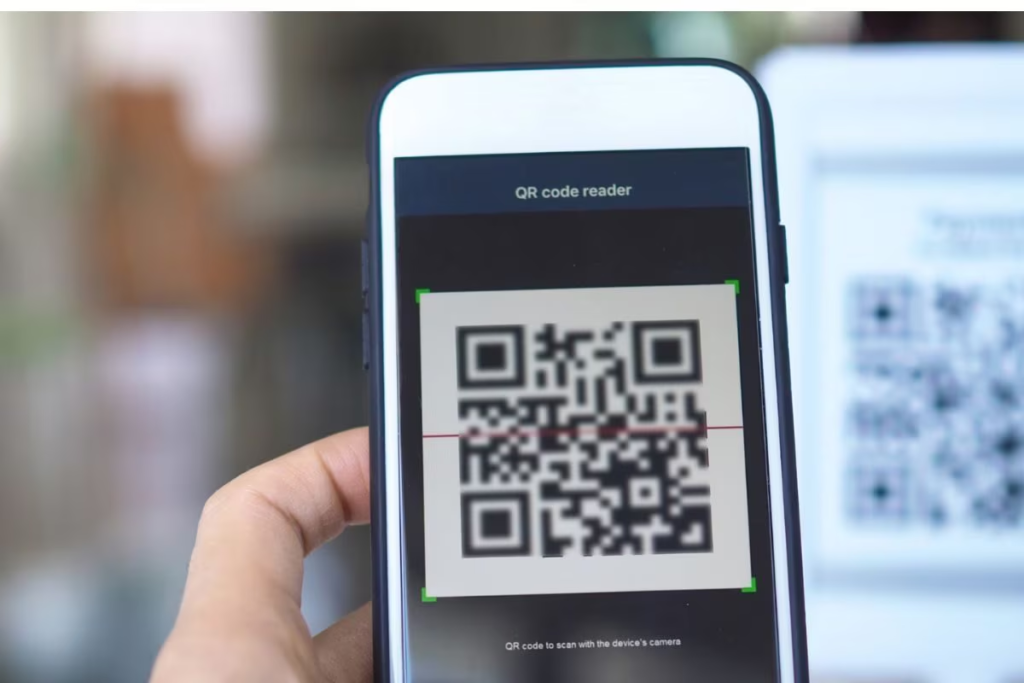

The National Payments Corporation of India (NPCI) has issued a new directive that will impact international UPI transactions made through shared QR codes. Effective April 30, users of apps like Google Pay, PhonePe, and Paytm will no longer be able to complete international Person-to-Merchant (P2M) transactions using QR codes saved or shared via images.

According to the NPCI circular issued on April 8, “QR Share and Pay shall not be allowed for all UPI Global P2M transactions and Payer PSP to ensure that Payer UPI app identifies the same.”

This means that if a user saves a QR code from a foreign merchant to their phone gallery and tries to pay later by scanning it, the transaction will be blocked. However, international payments can still be completed by scanning physical QR codes directly at the merchant’s location.

The restriction applies only to international P2M transactions via shared QR codes. There are no changes to domestic UPI transaction limits or functionality, including domestic QR Share and Pay. The current domestic limit for QR-based payments to non-verified offline merchants remains ₹2,000.

India’s UPI system is currently accepted in countries such as France, Mauritius, Nepal, Singapore, Sri Lanka, and the UAE.

Although NPCI has not explicitly stated the reason behind the move, the change appears to be a response to rising cases of cross-border fraud. Many scams have been linked to malicious actors overseas targeting Indian users. The new guideline is likely a preventative measure to curb such fraudulent activities and enhance user safety.